Insurance Claims

Use Case: Multi-party Insurance Claims in Real Time with Tellus

Tellus allows us to create a large number of processes attached to reality. We can evaluate almost any business idea.

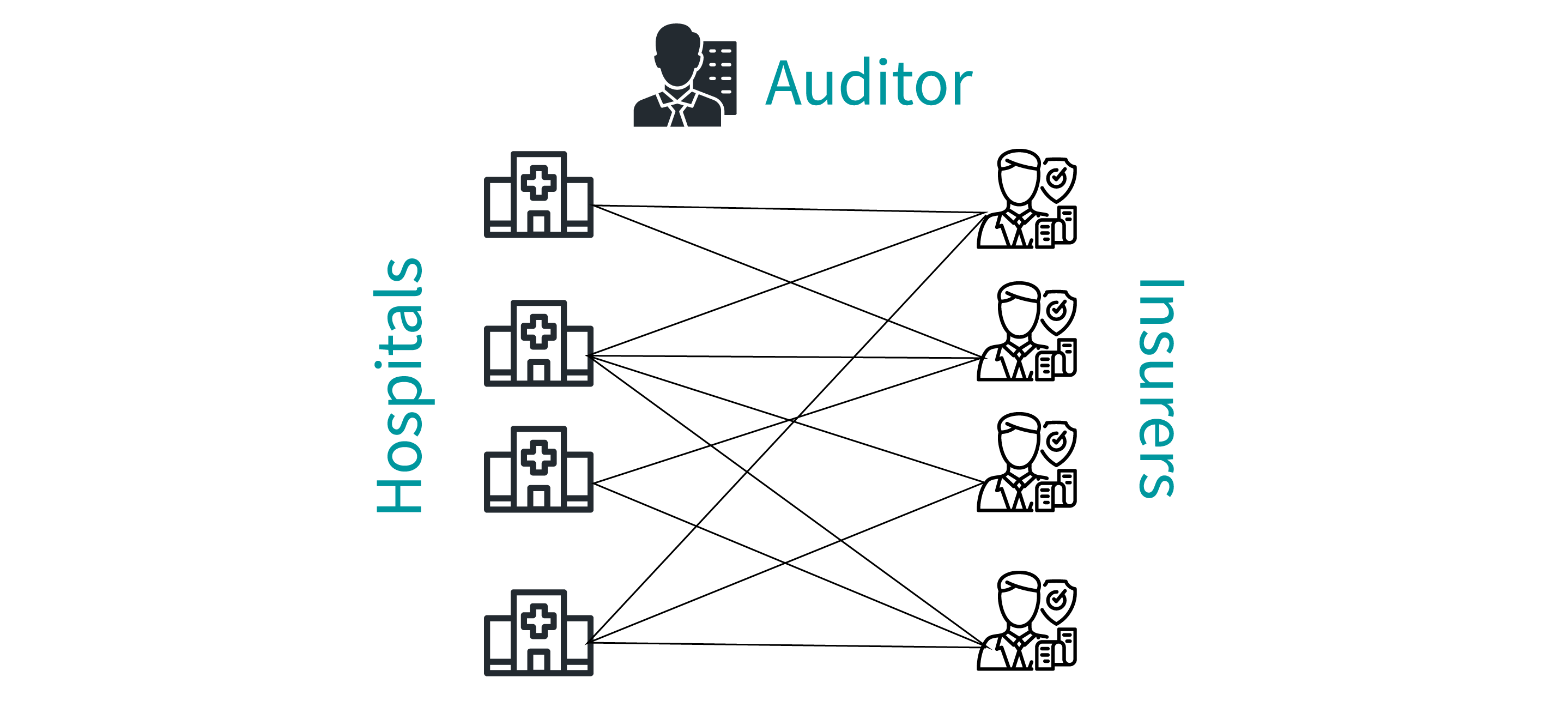

Here we show how to create an insurance claim using Tellus. In the insurance industry, a lot of parties have to exchange data on daily basis. Depending on the geography, some still use paper-based methods.

Either way, a single source of truth is valuable for these kinds of scenarios. Avoiding doing one on one integrations, or post mortem audits can increase the speed and quality of health services.

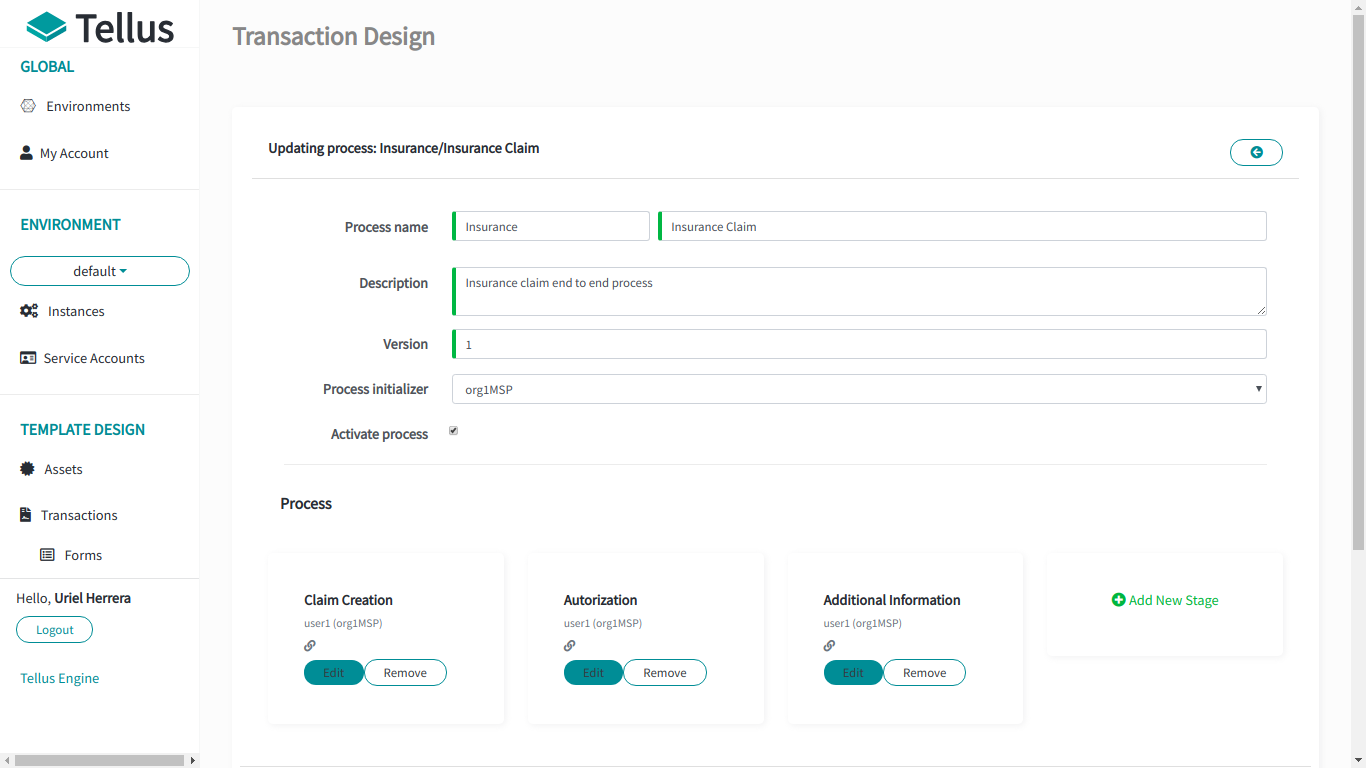

Transaction Design

Let’s start creating a macro transaction which involves all the value chain participants:

- The doctor makes an insurance claim.

- The insurer approves or rejects it in real time.

- The auditor can access the data without having to do post-mortem analysis and rely on each independent database of each hospital and insurer.

Tellus is based on transaction designs and flexible data structures that can be associated with assets.

How our transaction looks like:

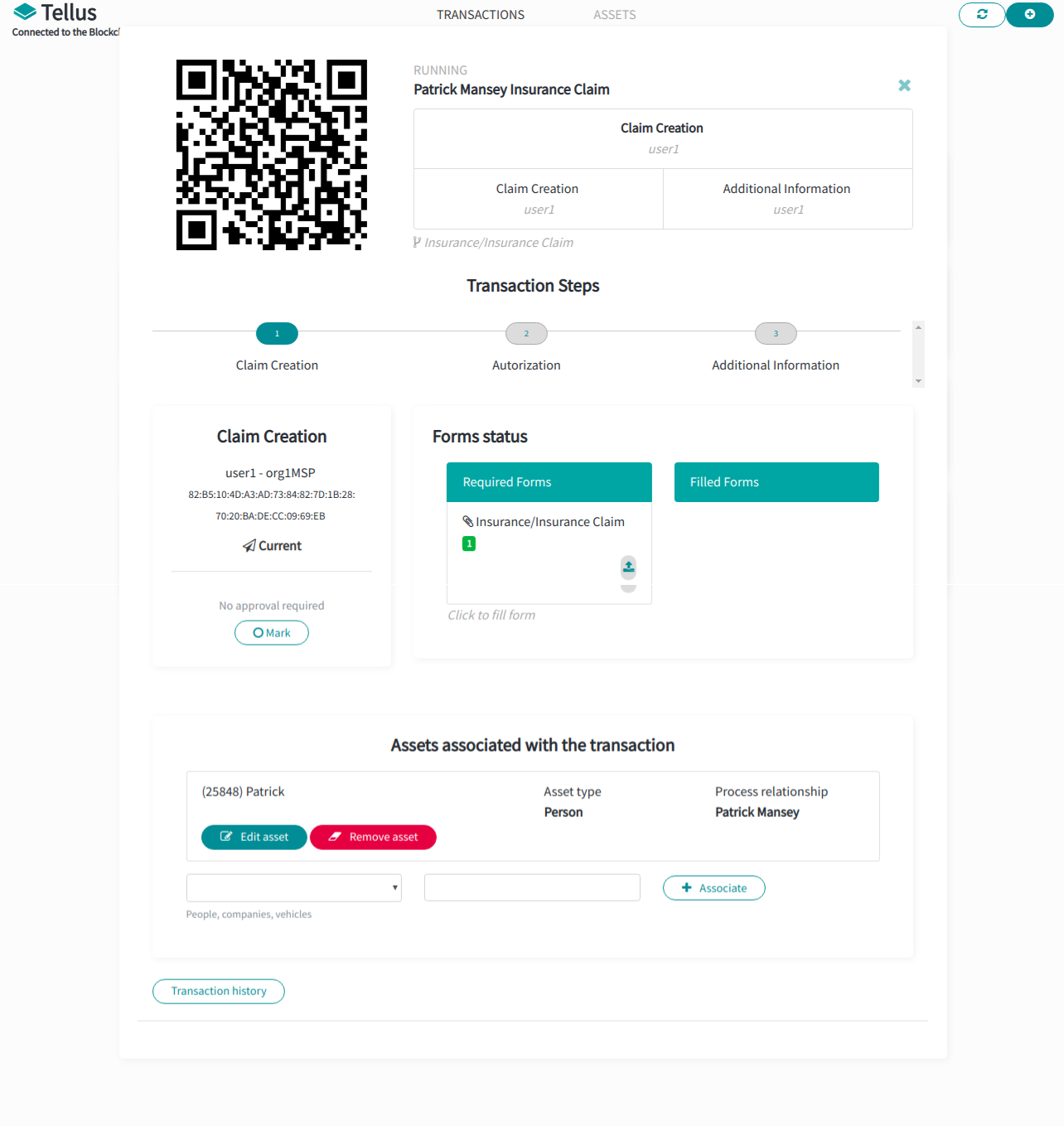

In the example above, the Transaction Template designs the high-level transaction and allows it to be executed and advanced through the physical interactions recorded by network participants.

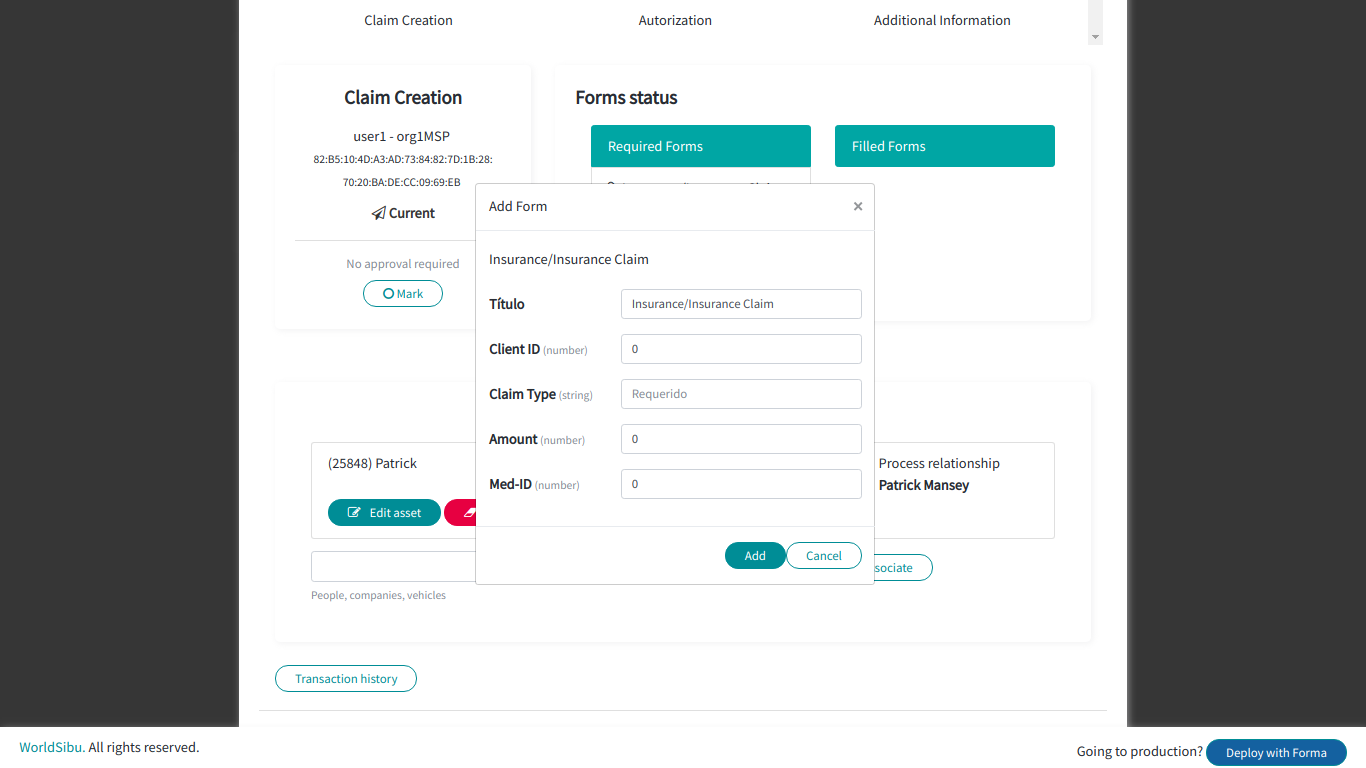

Each stage has different forms required to advance, for example:

- The doctor (or his secretary) must record certain details of the medical procedure.

- Then he sends the claim details to the insurer.

- In real time that data will be shared with those involved in that transaction (the insurer and the auditor).

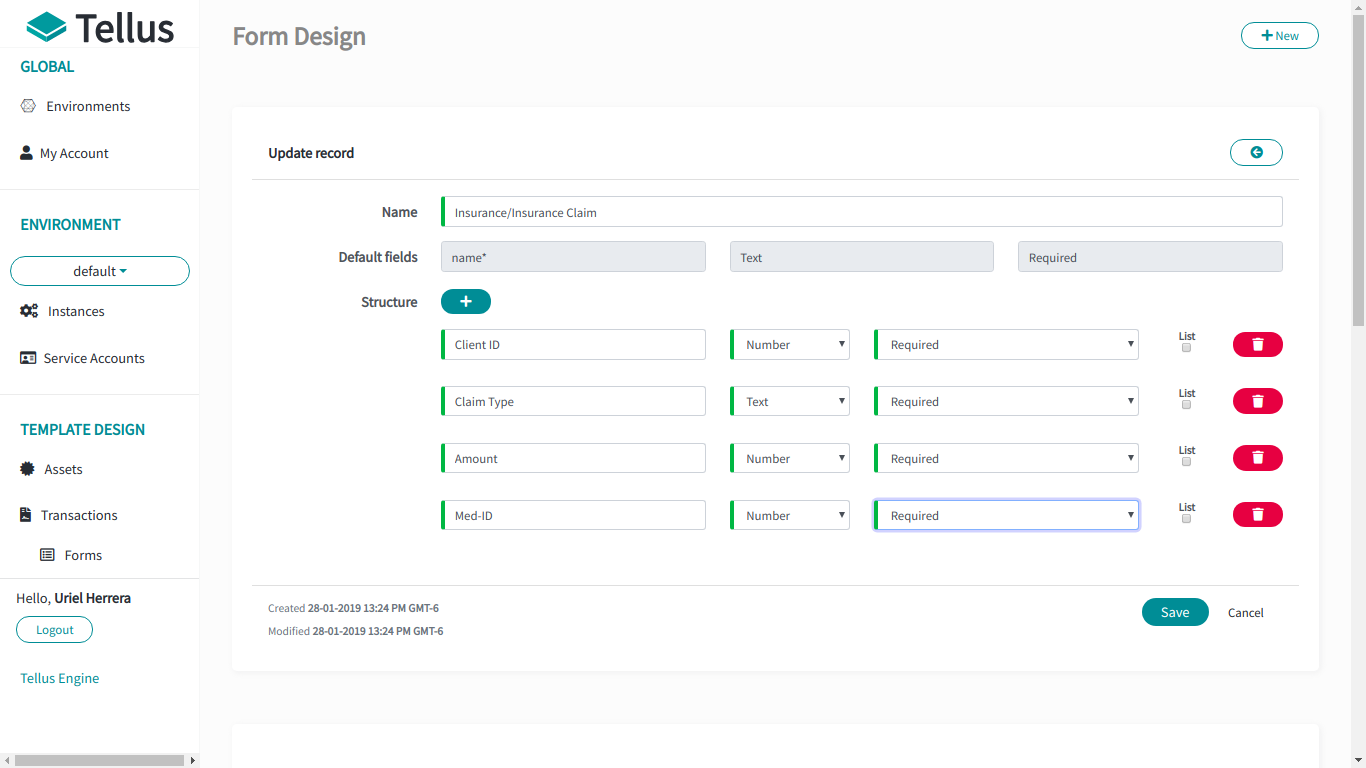

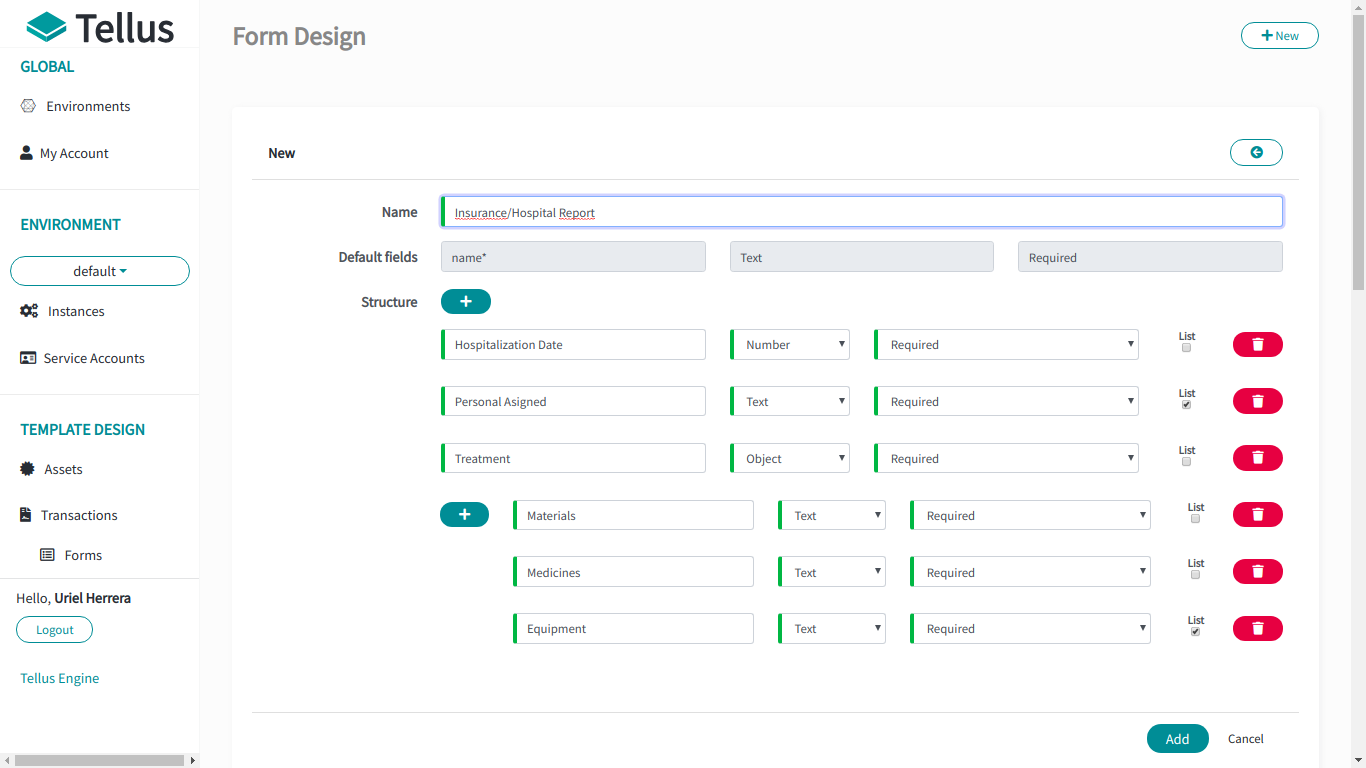

In this exercise, we have created several forms templates that must be attached by the participants of the transaction at different moments ensuring the information formats, details required in the blockchain, and the clear rules for each participant.

The logic here will be: on each stage (first screenshot) some forms must be added that the other participants will review to approve, reject or advance in a transaction.

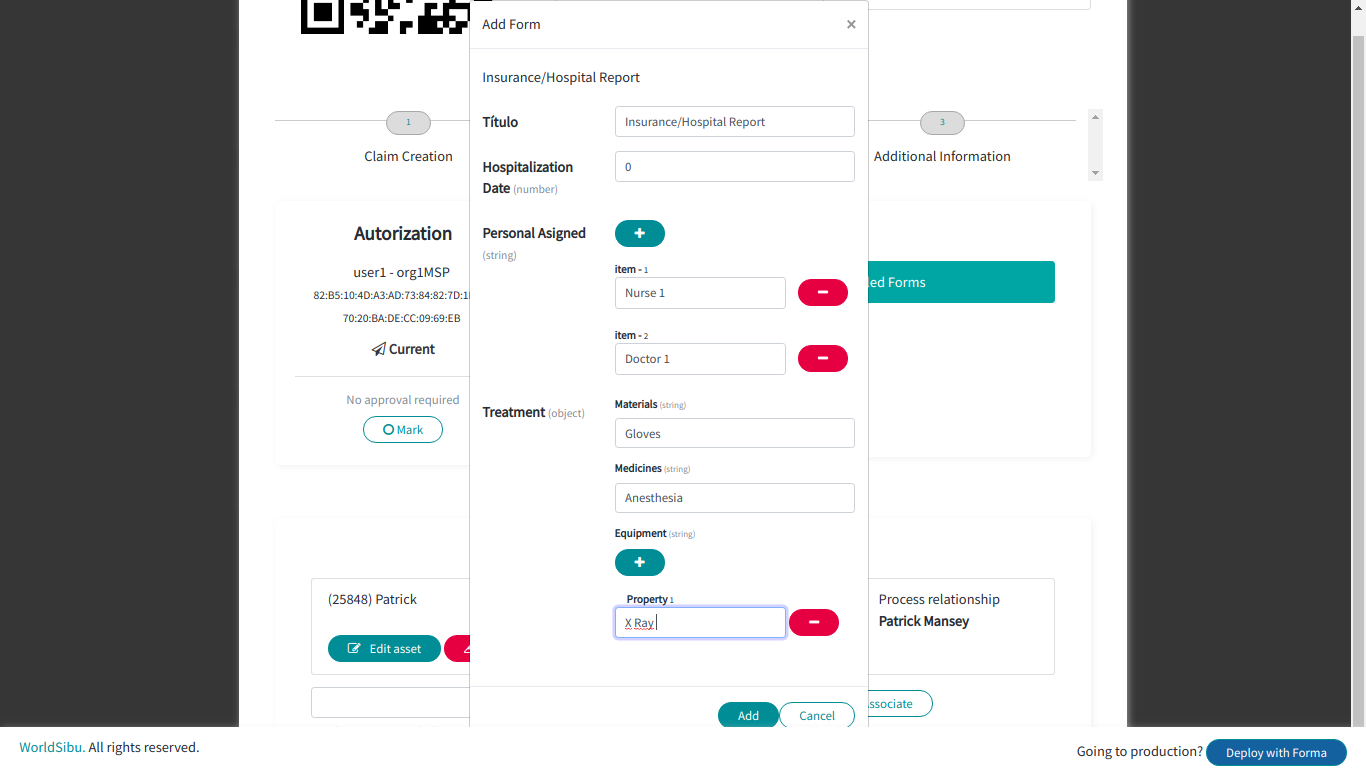

A form template can have any structure that we need, and you can attach as many forms to the same stage as you want. In the image below we see an example of Hospital Report that includes the date of hospitalization of the patient, the person assigned to attend the emergency and the treatment (medicines and materials) used to do all need procedures to cure the patient. The treatment feature is an object, which allows us to create a substructure associated with this line, and the assigned and equipment features are a list. The lists allow us to introduce different participants and assets at each feature. i.e, to attend the patient the hospital needs 3 nurses and 1 doctor, then the list allows us to reference each of these participants in the care.

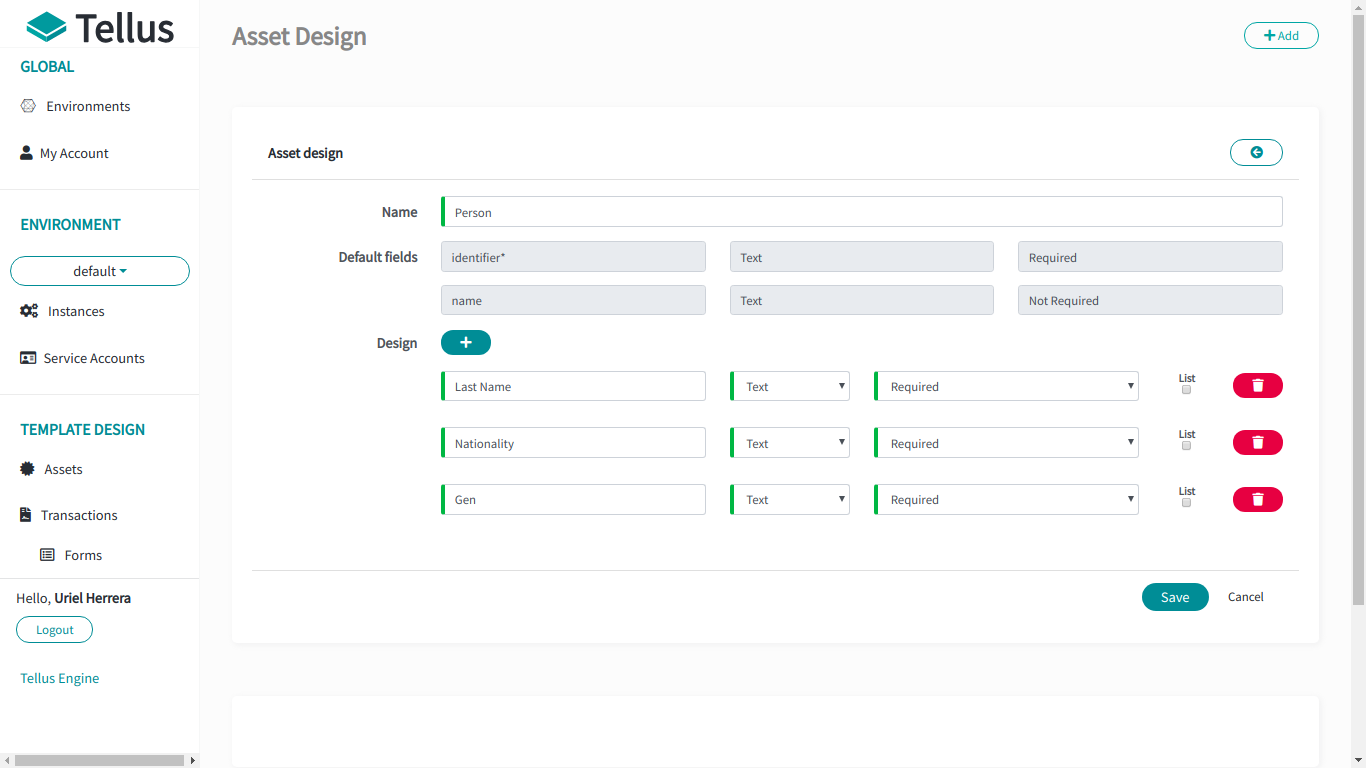

Assets

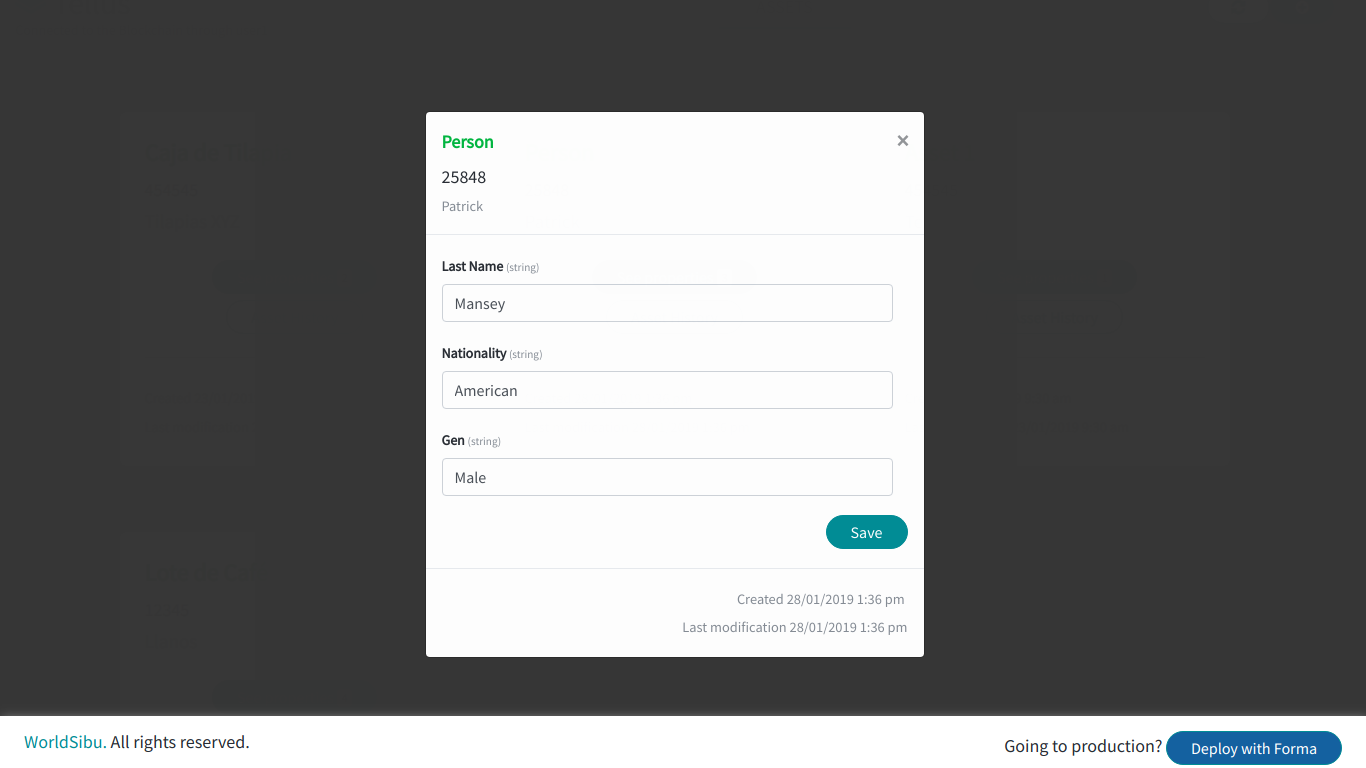

After creating the Transaction and Form Templates, we need to create an asset. An asset requires a structure so that the person in charge of it (for example, the Doctor) registers the information and subsequently it is associated with a business transaction. In this case, the asset is a person that realizes an insurance claim.

Executing the transactions on the blockchain between each participant

First of all, we create an asset. On the asset tab, select the asset template created in the admin UI.

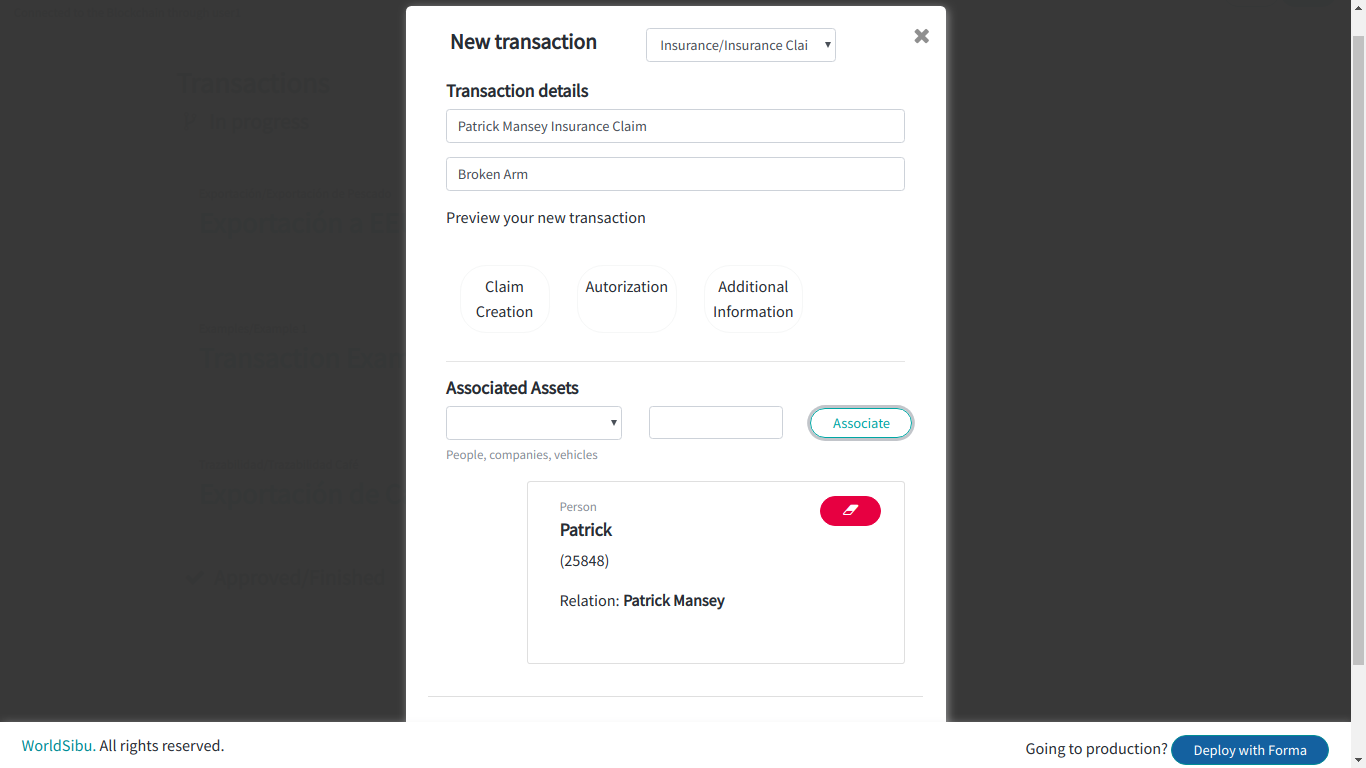

Then, we will select the transaction template, this will associate all the forms that are required to be able to advance in the transaction and limit that only the participants that must add data to a stage have access to the information.

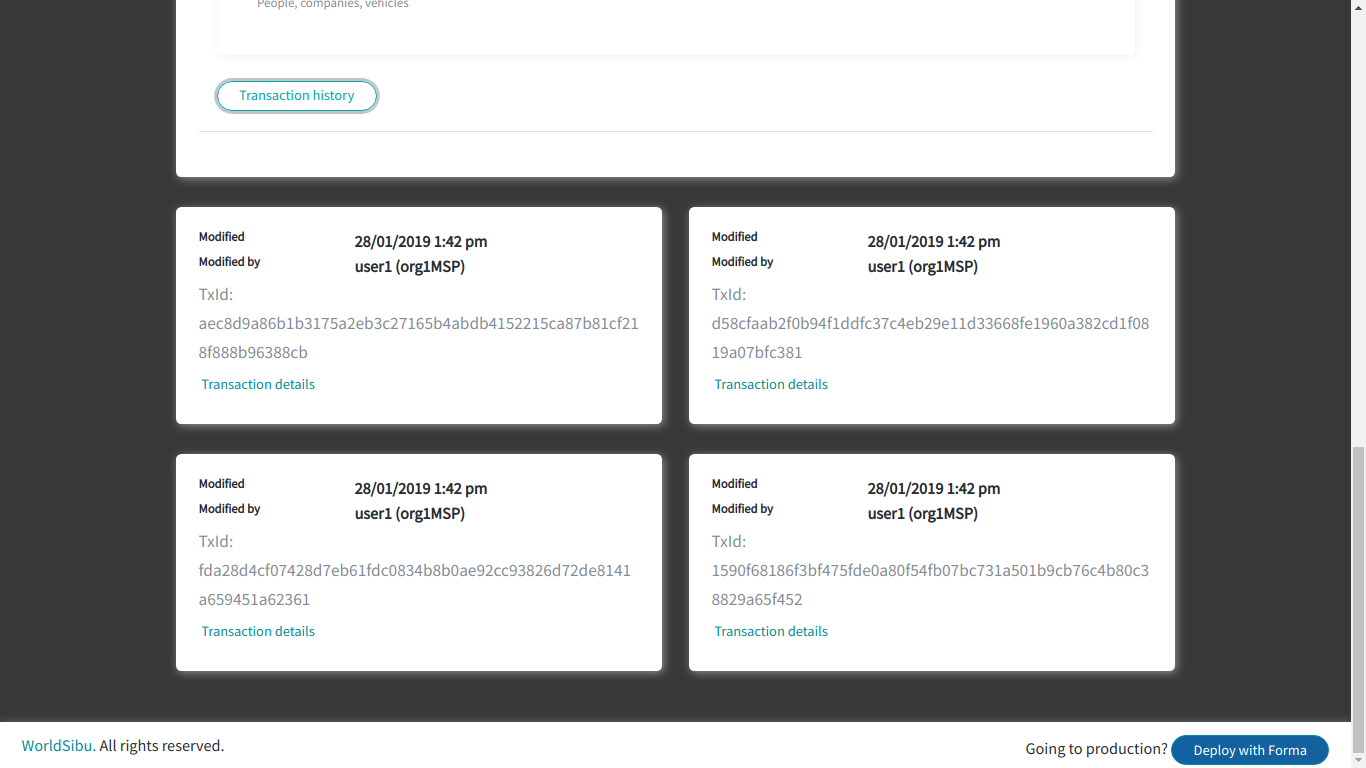

Once the transaction has been provisioned, we can start to formally make an insurance claim in real life in where each application will connect to the blockchain and each participant will be able to store the relevant data of that transaction in a single data source shared, but decentralized.

This process view allows you to visualize each stage, visualize the data that must be executed in each point and know which entity is associated with the process. For example, we can know all insurance claims of the same patient in any hospital, the patient can have control of their data to be stored in one place, and could even be given insurance approvals automatically because the insurer could integrate their systems to this data source and according to their rules and the type of insurance of each patient, provide a response without humans involved.

The auditor also, in real time, will be able to access each modification of the information, managing to visualize times, answers, quality of service, agreements and others registered in the blockchain.

Benefits of this transaction in Blockchain

- A simple and expeditious experience for the patient.

- The need for paper, transport of forms and errors by manual writing is completely eliminated.

- The patient can be given control over what information is shared.

- Ease of extending connectivity to more hospitals, in the case of insurers, and to more insurers in the case of hospitals.

- A single app for the patient to control all the insurance claims he has made with the hospitals and insurers of the network.

- The auditor may reduce the times of review and handling of disputes.

There are a lot of other advantages that bring register all the information in a single source of secure data where no participant can alter the “truth” of the information recorded. For example projections, pattern detection, the reputation of the participants, and a number of optimizations and cost reductions.